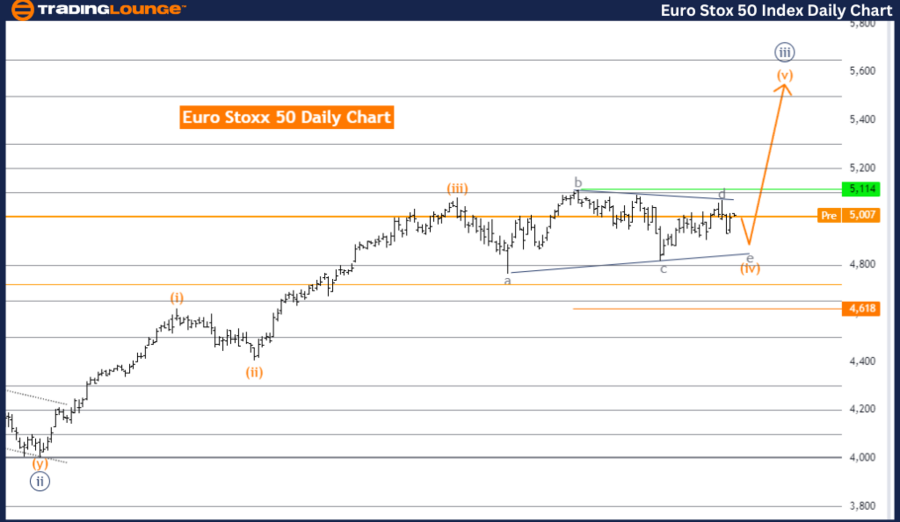

Euro Stoxx 50 Elliott Wave prognosis – Day-to-day chart

Overview

The Euro Stoxx 50 Elliott Wave prognosis on the day to day chart focuses on a counter development inner a corrective mode.

Vogue identification

-

Characteristic: Counter Vogue.

-

Mode: Corrective.

-

Construction: Orange wave 4.

-

Establish: Navy blue wave 3.

Most popular prognosis

-

Crucial points: Orange wave 4 is level-headed in play as a sideways circulate.

-

Invalidation Level: 4618.

Key points

- Corrective Counter Vogue: The prognosis identifies the event as corrective, indicating a consolidation section in opposition to the predominant development.

- Wave Construction: The level of ardour is on orange wave 4 inner the Elliott Wave structure. The present set is inner navy blue wave 3, indicating a corrective section.

- Subsequent Piece: The following expected section within the wave structure is orange wave 5, which could even resume the predominant development or continue the correction.

Detailed prognosis

- Sideways Circulation: Orange wave 4 is characterised by sideways circulate, indicating an absence of obvious directional bias and differ-sure market habits.

- Wave 4 Traits: The continued orange wave 4 signifies a length of fluctuation without an outstanding upward or downward development.

- Invalidation Level: The wave execute invalid level is made up our minds at 4618. If the market tag surpasses this level, the present wave prognosis could be invalid, indicating a critical market shift.

Conclusion

The Euro Stoxx 50 day to day chart prognosis identifies a counter development inner the Elliott Wave framework. The market is currently within the corrective section of orange wave 4 inner navy blue wave 3, marked by sideways circulate. This section is ongoing, with the next section being orange wave 5. The invalidation level at 4618 is a chief for confirming the present wave structure.

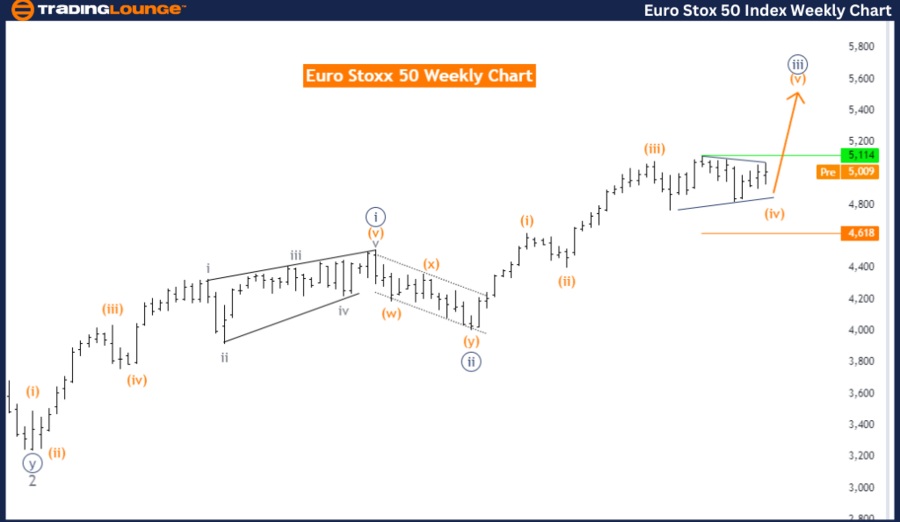

Euro Stoxx 50 Elliott Wave prognosis – Weekly chart

Overview

The Euro Stoxx 50 Elliott Wave prognosis on the weekly chart focuses on an outstanding development inner an impulsive mode.

Vogue identification

-

Characteristic: Vogue.

-

Mode: Impulsive.

-

Construction: Navy blue wave 3.

-

Establish: Gray wave 3.

Most popular prognosis

-

Crucial points: Navy blue wave 3 is currently in play.

-

Invalidation Level: 4618.

Key points

- Impulsive Vogue: The prognosis identifies the event as impulsive, indicating tough directional actions.

- Wave Construction: The level of ardour is on navy blue wave 3 inner the Elliott Wave structure, positioned inner grey wave 3, suggesting a sturdy upward development.

- Subsequent Piece: The following expected section within the wave structure is navy blue wave 4, which on the total represents a corrective section.

Detailed prognosis

- Navy Blue Wave 3: This wave is characterised by tough upward circulate, indicative of a sturdy market development.

- Subsequent Anticipated Piece: Navy blue wave 4 is anticipated to notice, marking a corrective section with that you’ll want to also imagine retracement in opposition to the prevailing development sooner than resuming the upward circulate.

- Invalidation Level: The wave execute invalid level is made up our minds at 4618. If the market tag surpasses this level, the present wave prognosis could be invalid, indicating critical market changes.

Conclusion

The Euro Stoxx 50 weekly chart prognosis highlights an impulsive development inner the Elliott Wave framework. The market is currently within the upward section of navy blue wave 3 inner grey wave 3, showing tough bullish momentum. The following section is anticipated to be navy blue wave 4, bright a corrective retracement. The invalidation level at 4618 is most well-known for confirming the present wave structure.

Euro Stoxx 50 Elliott Wave technical prognosis [Video]

As with all investment replacement there would possibly be a likelihood of making losses on investments that Procuring and selling Lounge expresses opinions on.

Ancient outcomes are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you can lose your entire investment. TradingLounge™ uses a differ of technical prognosis instruments, tool and fashioned traditional prognosis along with financial forecasts aimed at minimizing the doubtless of loss.

The advice we present thru our TradingLounge™ net sites and our TradingLounge™ Membership has been keen without enthusiastic about your goals, financial utter of affairs or desires. Reliance on such advice, records or records is at your trust likelihood. The resolution to alternate and the strategy of shopping and selling is for you by myself to advance to a resolution. This records is of a frequent nature easiest, so that you’ll want to also level-headed, sooner than acting upon any of the constructive wager or advice equipped by us, rob into consideration the appropriateness of the recommendation enthusiastic about your trust goals, financial utter of affairs or desires. Therefore, you’ll want to also level-headed consult your financial e book or accountant to search out out whether or no longer shopping and selling in securities and derivatives merchandise is acceptable for you enthusiastic about your financial situations.

![Euro Stoxx 50 Elliott Wave technical prognosis [Video]](https://www.freshworldnewstoday.com/wp-content/uploads/2024/07/217874-euro-stoxx-50-elliott-wave-technical-prognosis-video.jpg)

Leave a Reply